net investment income tax repeal 2021

The high tax rate on individual saving retards capital formation which depresses productivity and wages. 3 surtax for ultra-high earners with MAGI exceeding 5 million threshold applies to both joint and single.

After The Aca Tax Planning For The Current Net Investment Income Tax Cpa Practice Advisor

The Net Investment Income tax of 38 on net investment income for.

. How Do I Report the NIIT. The statutory authority for the tax is. The current provision acts more like a one-year delay as suspended losses can generally be taken as an NOL the following year against other types of income.

June 17 2021 by Ed Zollars CPA. Tax more commonly referred to as the net investment. The net investment income tax will apply to a taxpayer only if their modified adjusted gross income exceeds 250000 for married taxpayers filing jointly and surviving spouses 125000 for married taxpayers filing separately and 200000 for.

In the lawsuit the constitutionality of provisions of the ACA were addressed including the following. There is not going to be a net investment income tax repeal in 2021 but if the ACA is repealed in the future it is highly likely the NIIT would also be repealed. To give some background the net investment income tax is part of the Health Care and Education Reconciliation Act of 2010.

Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Since 2013 certain higher-income individuals have been. Subject to a 38 unearned income Medicare contribution.

For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax. The 38 Net Investment Income Tax. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

Additional Medicare tax of 09 on earned income greater than 200000 or 250000 if filing jointly. When a US District Judge in Texas ruled in 2018 that the Affordable Care Act had been rendered retroactively unconstitutional in its entirety by the Tax Cuts and Jobs Act a number of advisers. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

19-840 and a ruling is expected this spring. Under the kiddie tax rules children with 2021 or 2022 investment income above a certain amount may have part or all of their investment income taxed at their or their parents tax rates whichever is higher. The NIIT is set at 38 for the 2022 tax year.

Internal Revenue Service Code Section 1411 imposes a 38 tax on a taxpayers net investment income. In general net investment income for purpose of this tax includes but isnt limited to. The IRS gives you a pass.

38 surtax on net investment income over applicable threshold. Net investment income can be capital gains interest or dividends. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

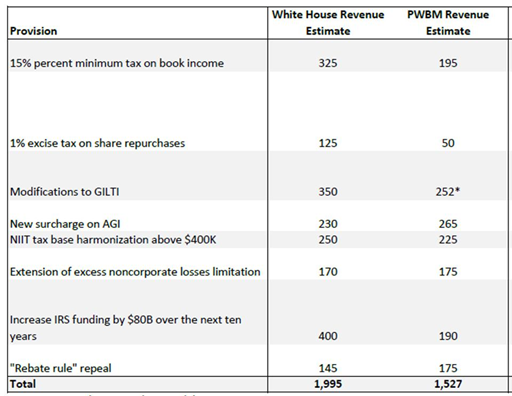

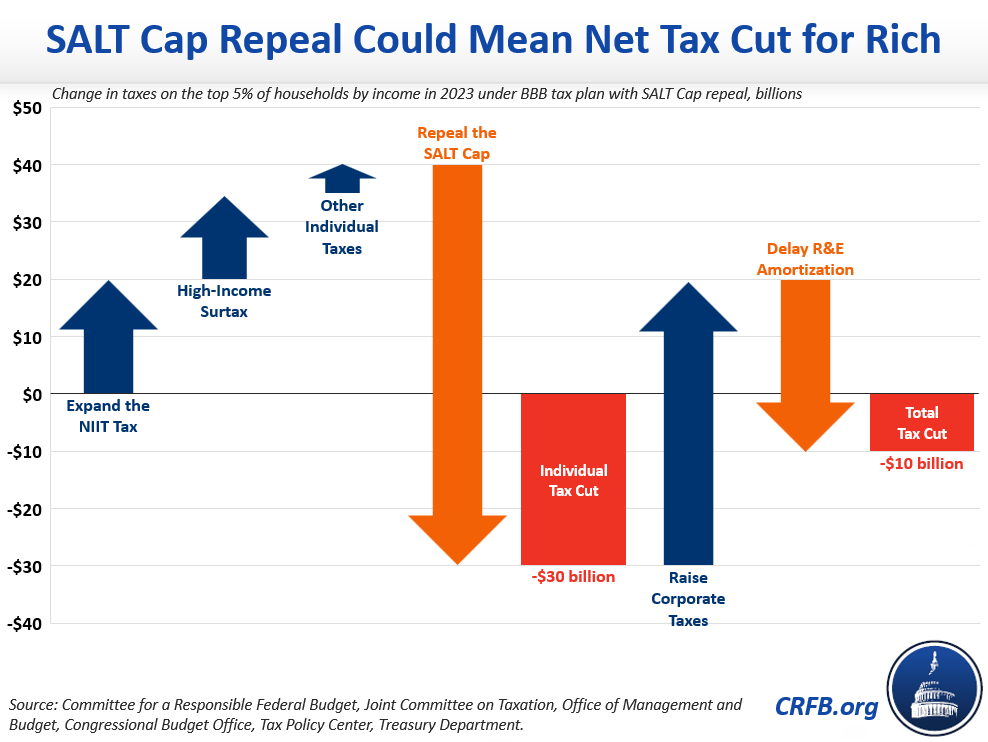

The provision would apply to any domestic corporation the stock of which is traded on an established securities market. Net investment income tax SALT cap The bill includes a long-awaited compromise on SALT cap relief. The Net Investment Income Tax form for individuals trusts and estates is Form 8960.

The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and. Qualifying widow er with a child 250000. The 38 Net Investment Income Tax under Internal Revenue Code Section 1411 would be broadened to include any income derived in the ordinary course of business for single filers with more than.

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. In November of 2020 the Supreme Court held oral arguments in the case California v. The SECURE Act repealed the provision in the TCJA pegging the kiddie tax to the trust and estate tax rates.

Supreme Court Rules Plaintiffs Did Not Have Standing to Challenge Affordable Care Act Net Investment Income Tax Remains in Force. The House Republican proposal to repeal and replace the Affordable Care Act would eliminate several taxes. Under the new provision the cap would be extended to 2031 and the cap would be increased from 10000 to 80000.

The bill would impose a tax equal to 1 of the fair market value of any stock of a corporation that the corporation repurchases during the year effective for repurchases of stock after Dec. While the NIIT might seem out of place here it was actually created to help fund the aforementioned healthcare reforms. 1 It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect.

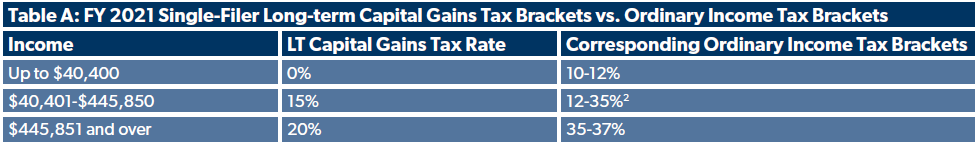

3 This includes a 25 long-term capital gains tax rate a 38 net investment income tax and a 3 surtax on individuals with modified adjusted gross income exceeding 5 million. You are charged 38 of the lesser of net investment income or the amount by. If the Supreme Court were to repeal Obamacare in part or whole it is possible that 38 tax on Net Investment Income and the 09 Additional Medicare tax under Obamacare would also be repealed.

Assume his net earnings from self-employment are US208700. Conversely a single taxpayer would owe 4750 with the same facts MAGI is. However in determining his self-employment tax T cannot use the FEIE amount to reduce his self-employment income.

Affordable Care Act Repeal Lawsuit. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. House Ways and Means Committee tax proposal September 13 2021.

However a ruling from the Supreme Court that the ACA was constitutional prior to the enactment of the TCJA might eliminate a taxpayers ability to claim a refund of the net investment income tax or the additional Medicare tax for the 2016 through 2018 tax years prior to the effective date of the repeal of the individual mandate on January 1. For example a married couple with wages of 225000 and investment income interest dividends capital gains etc of 125000 currently owe an additional 3800 225000 125000 250000 x 38 in taxes when filing their individual income tax return. The Net Investment Income Tax is a bad tax and its repeal will benefit everyone.

That means your deductions could put you in the lowest income tax bracket yet you could still have investment income that is subject to the surtax. Top marginal rate is 37. Also the capital-gains income tax rate for high-income taxpayers stands at 20 in 2021 so the total federal tax on capital gains with the surtax could be 238 in 2021 and beyond.

Financial Planning Now In Anticipation Of The Upcoming Election Aaa Cpa

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The The Net Investment Income Tax Niit Forbes Advisor

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Forbes Highlights Hit To Pass Throughs The S Corporation Association

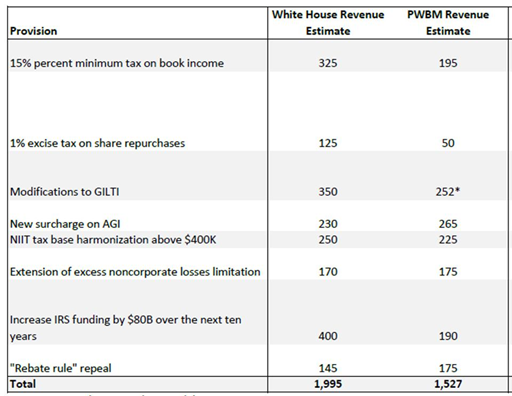

The Build Back Better Tax Plan Broadly Benefits All But The Very Wealthiest West Virginians West Virginia Center On Budget Policy

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Buying Investment Property

Net Investment Income Tax Schwab

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

The Power Of 1031 Like Kind Exchanges Ppt Download

Biden Tax Plan And 2020 Year End Planning Opportunities

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

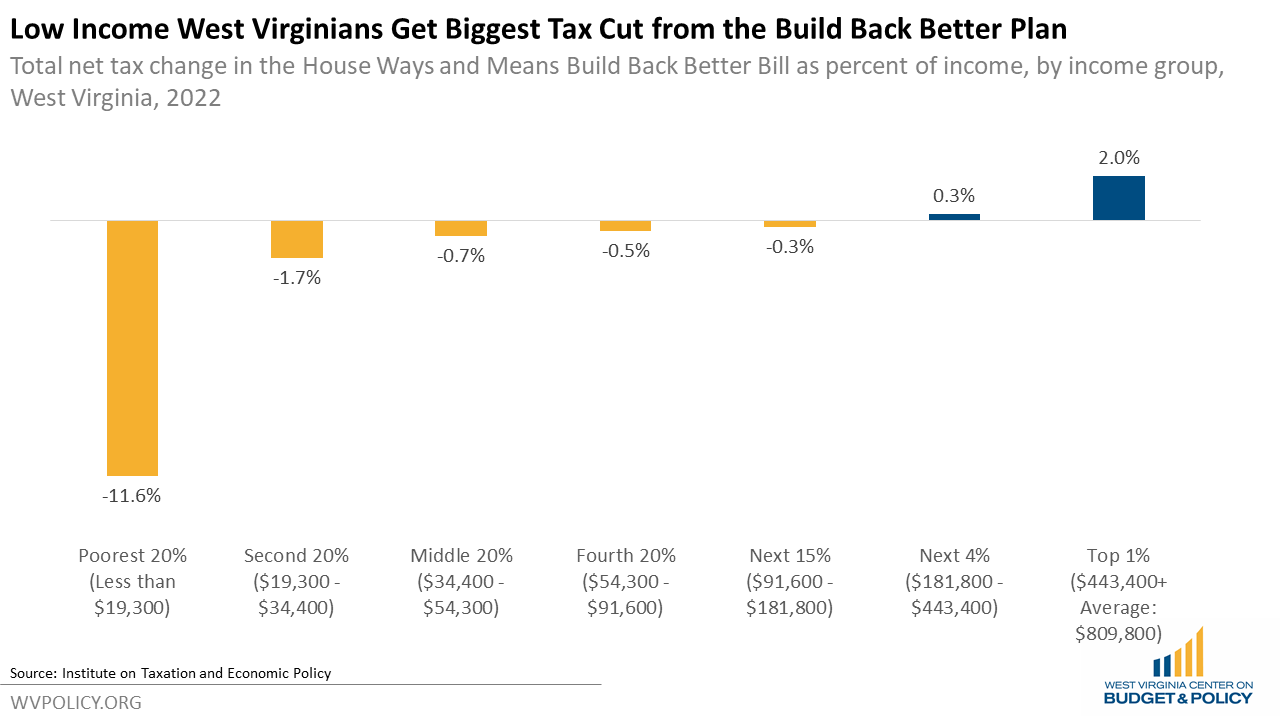

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

What S The Deal With Capital Gains Taxes Foundation National Taxpayers Union

Congress Readies New Round Of Tax Increases

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center