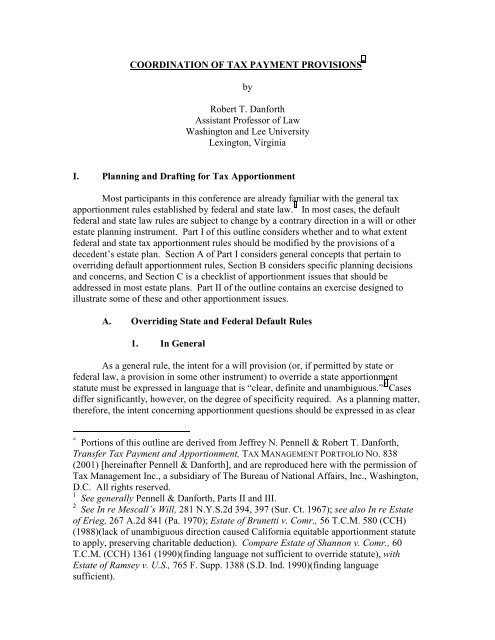

florida estate tax apportionment statute

2021 Florida Statutes 733817 Apportionment of estate taxes. Until its recent revision the.

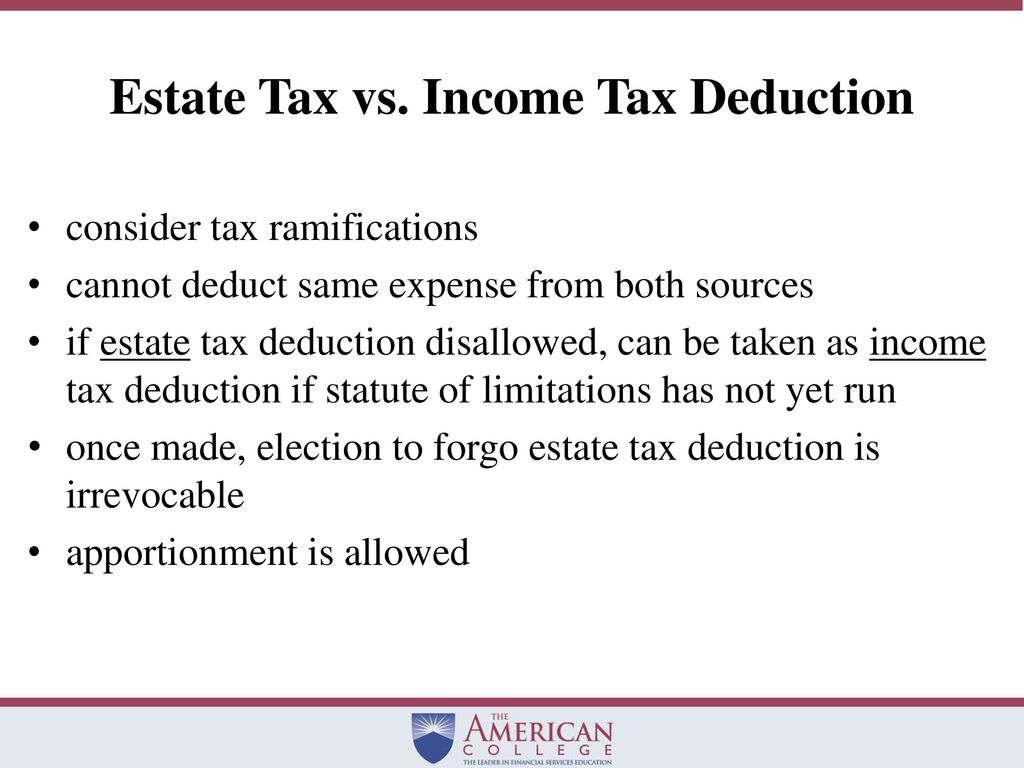

Welcome To This Week S Online Class With The American College Ppt Download

4 Laws 2015 c.

. As determined by the Internal Revenue Code with respect to the federal estate tax and the Florida. 733817 Apportionment of estate taxes. 3 See Braun Akins Price Improvements Made to Floridas Estate Tax Apportionment Statute Action Line Summer 2015 p.

2 An interest in protected homestead shall be exempt from the apportionment of taxes. Floridas Estate Tax Laws--Apportionment Versus a Change Against Published by UF Law Scholarship Repository 1959. No Florida estate tax is due for decedents who died on or after January.

The value of an interest shall not be reduced by reason of the charge against it of any part of the tax. Trust Bank of America Private Wealth Management. A Remainderman means the holder of the remainder interests after the expiration of a tenants.

733817 Apportionment of estate taxes. Of the Florida Statutes the Apportionment Statute which is the section of the Florida Probate Code that governs the apportionment of estate taxes2 The impetus for the Amendment was a. The Estate Tax Law of Florida imposes a GST tax based on the amount allowed as a credit for state legacy taxes under IRC 2604.

See Part IV for a discussion of. Improvements Made to Floridas Estate Tax. Bank of America NA.

Chapter 198 Florida Statutes. The Florida apportionment statute has finally received a welcomed facelift. Traditionally the common law pre-sumed that estate taxes were.

FLORIDAS TAX APPORTIONMENT STATUTE By. The 2022 Florida Statutes. Estates of Decedents who died on or after January 1 2005.

Ws will does not contain a tax apportionment clause. FLORIDAS ESTATE TAX LAWS tax is a charge against the. NEW FLORIDA APPORTIONMENT OF ESTATE TAXES Florida Laws 1949 c.

As determined by the Internal Revenue Code with respect to the federal estate tax and the Florida estate tax and as that concept is otherwise. QTIP bears the additional estate taxes arising due to its inclusion in Ws federal gross estate by reason of. Floridas current apportionment statute originated in 196321 and was amended in 196522 The 1965 amendments included foreign estate and in- heritance taxes in the apportionment.

25435 Chapter 25435 enacted by the Florida Legislature in 1949 provides that unless the decedent has. FLORIDAS TAX APPORTIONMENT STATUTE By. A proposal to alter the text of a pending bill or other measure by striking out some of it by inserting new language or bothBefore an.

Terms Used In Florida Statutes 733817. An analysis of the history of estate tax apportionment reveals the clear effect of Floridas apportionment statute. Improvements Made to Floridas Estate Tax Apportionment Statute Action Line Summer.

738801 Apportionment of expenses. The revised apportionment statute became effective October 1 1992. As determined by the Internal Revenue Code with respect to the federal estate tax and the Florida estate tax and as that concept is.

Debunking Last Will And Testament Myths Haimo Law

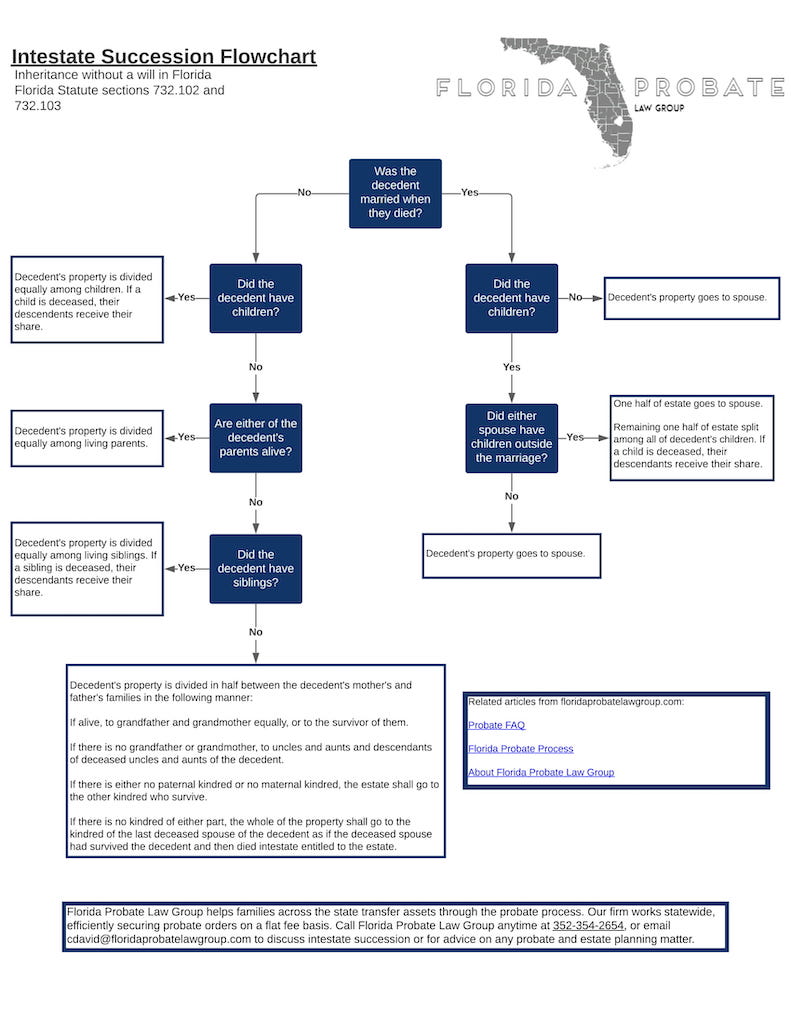

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

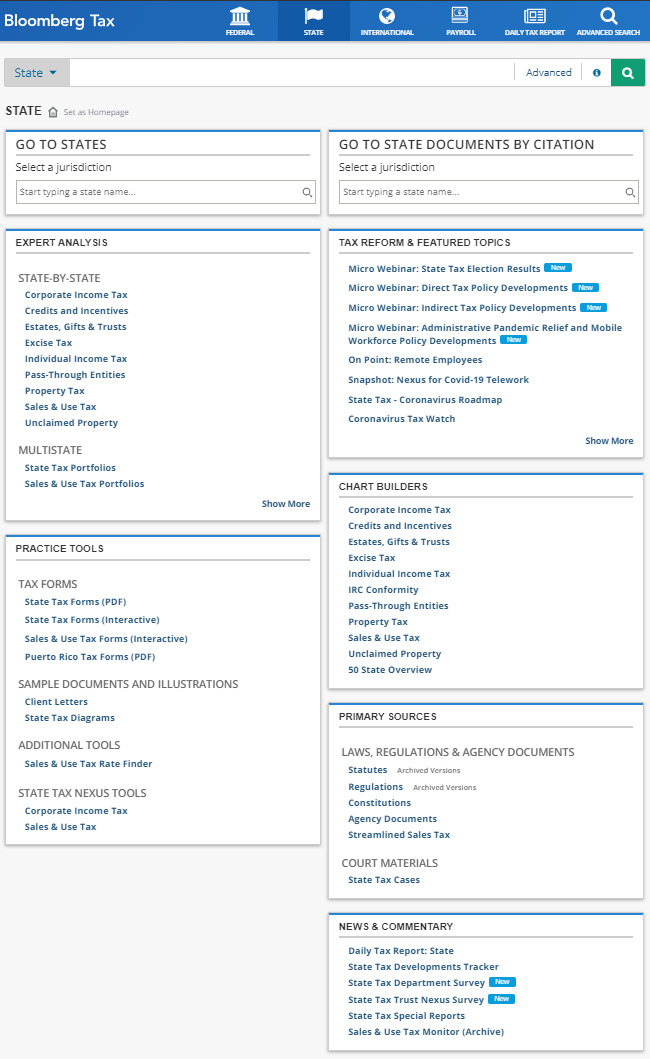

State Tax Update The Shift From Cost Of Performance To Market Based Sourcing Marcum Llp Accountants And Advisors

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

2015 Florida Trust And Estate Legislative Roundup Florida Probate Trust Litigation Blog

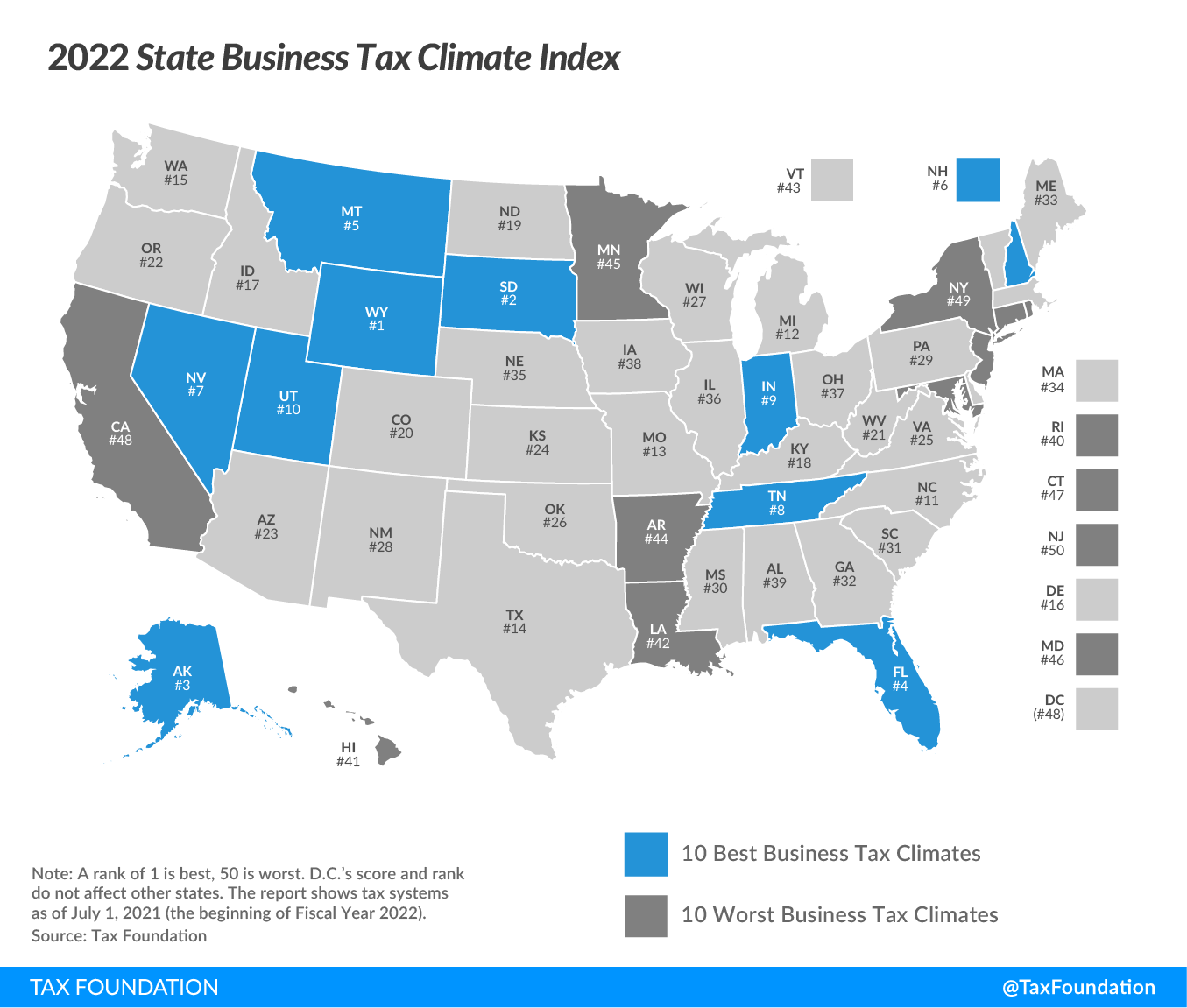

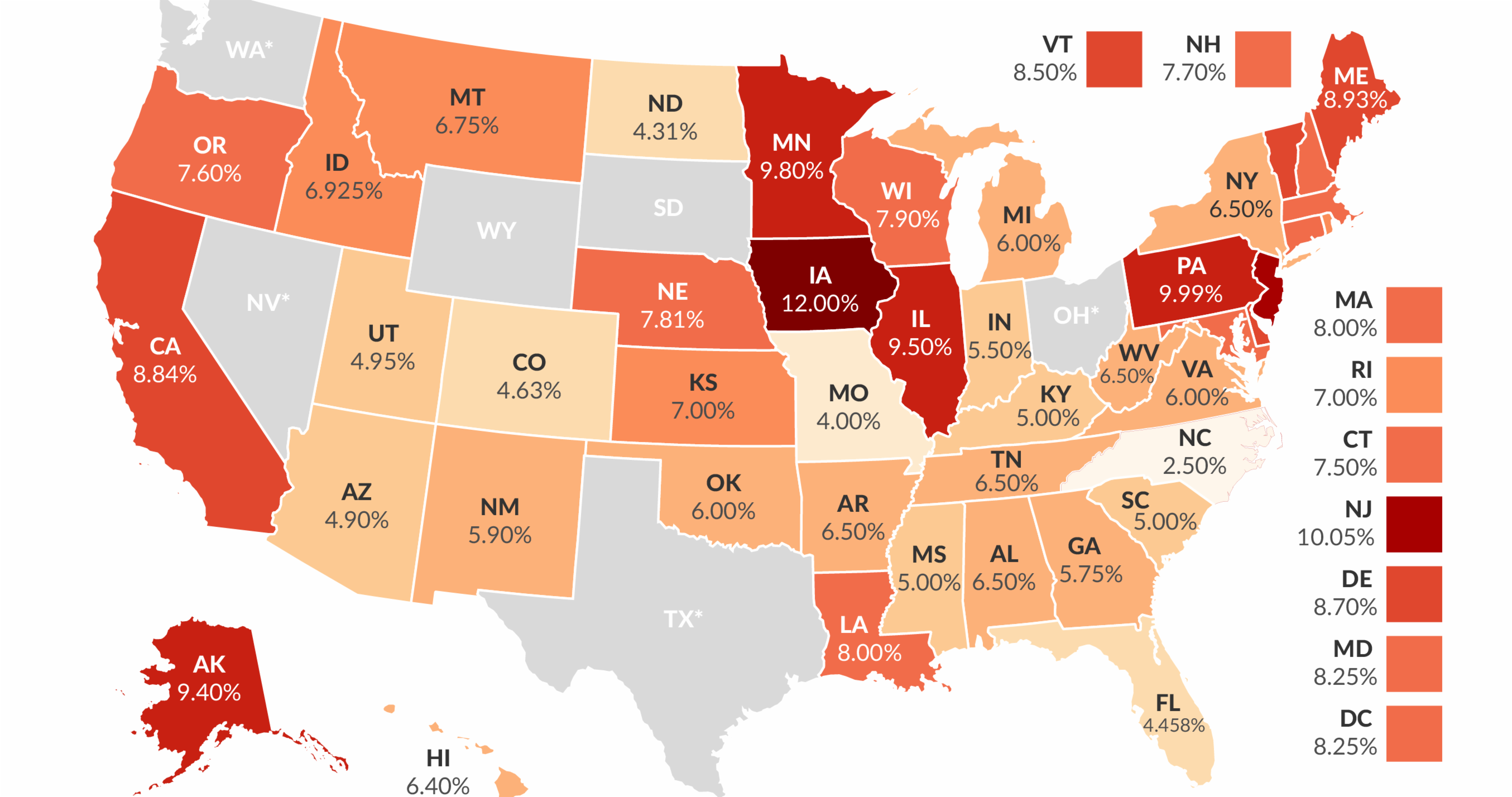

2022 State Business Tax Climate Index Tax Foundation

State Corporate Income Tax Rates And Brackets For 2020

Georgia Bar Journal April 2012 Page 51

Giving The Bird Lady Bird Deeds Florida S Title Insurance Company

How Can You Reduce Your State Tax Apportionment

When Does A Surviving Spouse S Elective Share Take An Estate Tax Hit Florida Probate Trust Litigation Blog

Csc Florida Laws Governing Business Entities Annotated Florida Bar

Tools And Strategies To Avoid Estate Planning Tragedies

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

News Events Blogs Page 76 Of 149 Dean Mead

Pdf Format American College Of Trust And Estate Counsel

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

2014 Chapter I Basic Estate Planning In Florida Lauer Law P A